By Austin Duerfeldt – Nebraska Extension Agricultural Systems Economist Educator

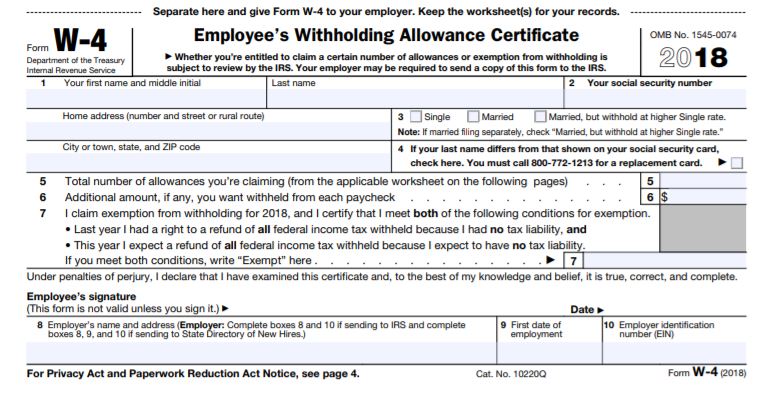

The new US tax bill is in full effect. While we wait for the IRS to provide a full interpretation, we do have more information on some sections. One in particular that has some tax preparers nervous for their clients is federal withholding. With the higher standard deduction and changes in child credits, taxpayers may need to reconsider how much to withhold for federal taxes in each pay period.

One issue is doubling up on dependents on the W-4 you file with your employer. For example, let’s say you are married and filing jointly with two kids. On your W-4 you file as married with two kids. Your spouse’s W-4 also files as married with two kids. By both filing the W-4 as married with two kids you will see more in your monthly paycheck, but may end up with a large federal tax bill come next spring. The problem is due to the fact that the full child credit is considered on your W-4 as well as your spouse’s W-4. When you file your return though, you only receive the full credit once. Now is a perfect time to double check and ensure you won’t have a surprise next spring when you see your tax bill.

TOOLS FROM THE IRS

If you are a do-it-yourself tax preparer, or want to get an idea of how withholding changes may affect you, take a look at the handy IRS Federal Withholding calculator (https://apps.irs.gov/app/withholdingcalculator/).

The calculator will ask questions such as your filing status, number of dependents, child/dependent care credit, earned income credit, and estimated income for the year. (Having out your last pay stub and last year’s tax return will make the process go faster.) Once you have completed the questions, it will respond with your anticipated income tax and whether your current withholding will lead to an overpayment or underpayment and how much it would be. If you find yourself in a situation where your withholdings are uncomfortably off from the estimate, there is a link to a Form W-4 so you can make adjustments. Making changes now gives you five to six months to spread out the adjustment.

Again, every situation will be different. You may be spot on with your current withholding amount. Others may need to claim zero plus take additional voluntary withholdings to get back on track. This calculator works for most taxpayers. The IRS recommends referring to Publication 505 (https://www.irs.gov/pub/irs-pdf/p505.pdf) for more complex tax situations.

TALK WITH YOUR TAX PREPARER

This is just one of many changes in the tax code that needs to be looked at this tax year. Setting up a meeting with your tax preparer in the next few months could provide some beneficial advice as to how your operation should move forward. Waiting until late November or December to meet could lead to some costly errors and missed opportunity for this 2018 tax year. For those of you who prepare your own tax return it might be beneficial to talk with a tax preparer for this year to grasp what changes you need to be aware of. Another option would be to attend one of the university’s Tax Institute seminars that will be held around Nebraska this fall.

To listen to BeefWatch podcasts go to: https://itunes.apple.com/us/podcast/unl-beefwatch/id964198047 or paste http://feeds.feedburner.com/unlbeefwatch into your podcast app.