Volunteer Income Tax Assistance (VITA)

We are reaching out to invite students to get involved in a meaningful volunteer opportunity that directly benefits our local community.

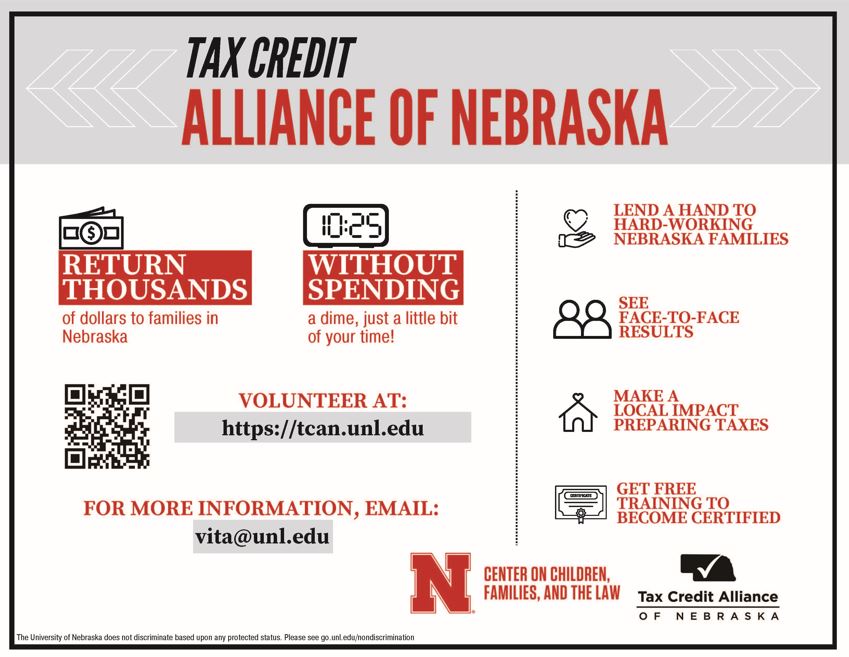

The VITA program provides free tax preparation services to low- and moderate-income individuals and families, individuals with disabilities, non-filing families with children, individuals who speak English as an additional language, students, and taxpayers over 60. We aim to help individuals and families who would otherwise be underserved receive the credits and economic support they deserve.

We are currently seeking enthusiastic volunteers who are interested in learning how to prepare taxes and helping others in our community.

Volunteer Benefits:

- Free Training - Comprehensive training sessions provided by the IRS that equip volunteers with the skills and knowledge needed to prepare taxes effectively and become IRS-certified tax preparers.

- No experience required

-Set your own schedule

-Community Impact: ** This is a chance to give back to the community while gaining valuable experience and skills.

- Experiential Learning Opportunity

- Volunteer appreciation certificate

- Volunteer appreciation party (after tax season)

Volunteer Roles Needed

No tax certification required

• Greeter/ Screener - You greet everyone visiting the site to create a pleasant atmosphere. You screen taxpayers to determine the type of assistance they need and confirm they have the necessary documents to complete their tax returns. Tax law certification is not required for this position.

• Interpreter - You provide free language interpreter services to customers who are not fluent in English. Basic tax knowledge is helpful, but it is not required for this position.

Tax Certification Required

• Tax Preparer - You complete and successfully certify in tax law training, including the use of electronic filing software, to provide free tax return preparation for eligible taxpayers.

• Site Coordinator - You have excellent organizational and leadership skills. You are the primary resource for sharing your knowledge of the program and are available to assist with any issues that may arise. You develop and maintain schedules for all volunteers to ensure adequate coverage, supplies and equipment at your site. Tax law certification is not always required for this position.

• Expert Tax Consultant - You provide tax law assistance and guide taxpayers in preparing their own tax returns. Tax law certification is required for this volunteer role and training is available on-line or through face-to-face instruction.

• Quality Reviewer - You review tax returns completed by volunteer tax preparers, ensuring that every taxpayer receives top quality service and that the tax returns are error-free. You must be tax law certified at least at the Intermediate level.

If any interested students would like more information about becoming a volunteer or the training schedule, please feel free to contact me.

For more information visit us at: https://tcan.unl.edu/

To sign up as a volunteer: https://tcan.unl.edu/volunteer-sign-up/

Thank you for considering this opportunity to make a meaningful impact together. We look forward to hearing from you soon.

More details at: https://tcan.unl.edu/