Tax Preparers have a few more requirements than other volunteers. Tax assistants must earn tax law certification and attend a Tax Slayer training session. Four Tax Law Help sessions are provided in order to help make sure a volunteer can pass the necessary certification tests. If you do not have previous experience with taxes, don't worry!

There is no cost of training to become a tax assistant. All of your materials, software, training, and test(s) are provided by the Internal Revenue System (IRS), Lincoln VITA Coalition, and by the Center for Civic Engagement's Service-Learning. In order to serve in the capacity of a tax assistant, you should present your certificate denoting completing of volunteer certification to Service-Learning (222 Nebraska Union) by January 22, 2017. If you anticipate being unable to complete your certification by this time but would like to serve as a tax assistant, you should still attend the tax law workshops and software training and should contact Linda Moody, Ph. D. at (402) 472-6412 about delaying the completion of your certification. There are six types of certification for tax preparers.

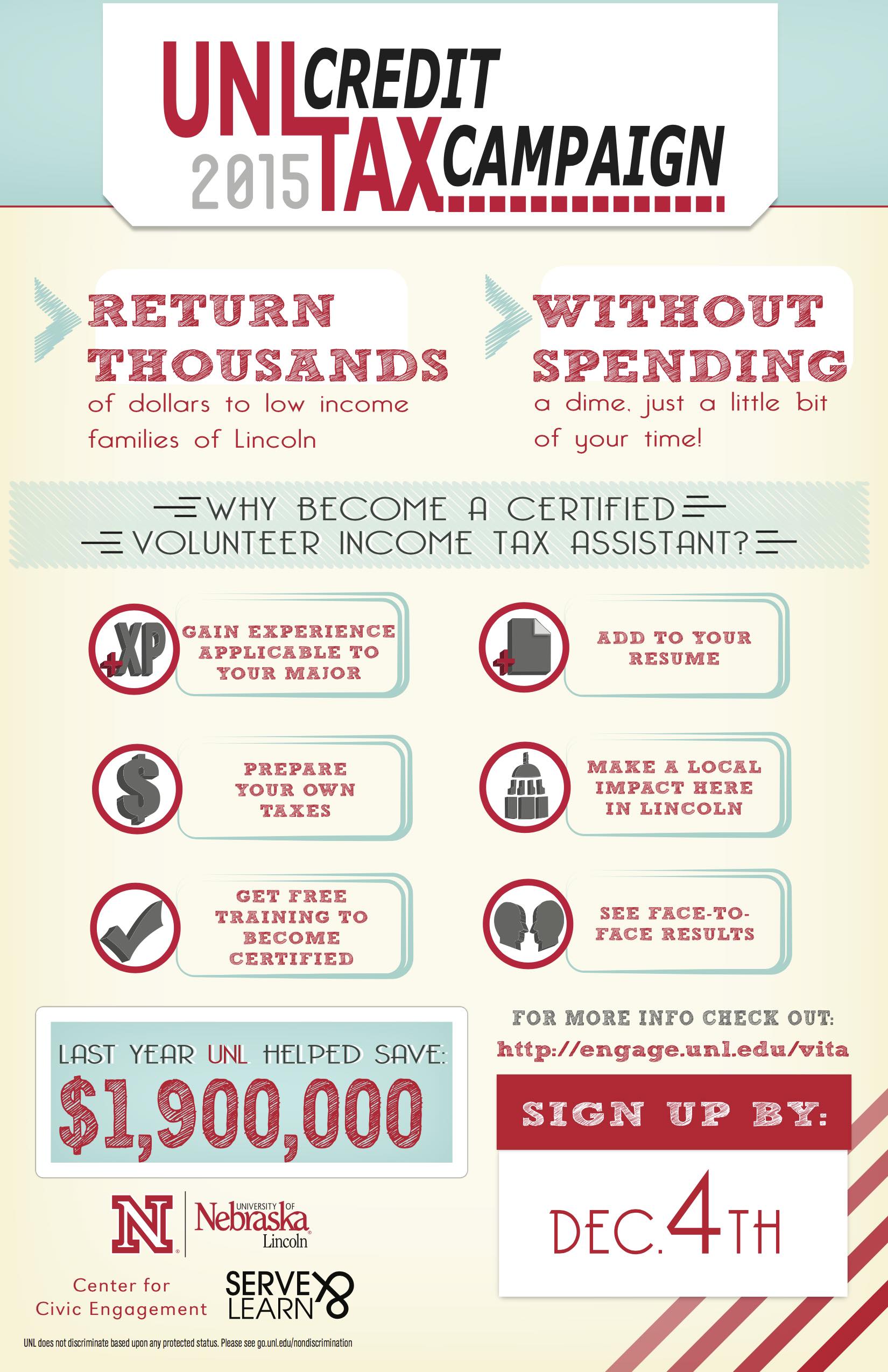

More details at: http://engage.unl.edu/vita