The University of Nebraska–Lincoln Department of Agricultural Economics annually surveys land industry professionals across Nebraska including appraisers, farm and ranch managers, agricultural bankers and related industry professionals. Preliminary results from the survey are divided by land class and summarized by the eight Agricultural Statistic Districts of Nebraska.

Land industry professionals responding to the annual survey attributed the rise in Nebraska farm real estate values to higher commodity prices, interest rates near historic lows, hedging against inflation and renewed use in 1031 exchanges. These forces substantially impacted farm and ranch finances across Nebraska. The financial position of many operations improved over the prior year despite rising machinery costs and input expenses. Current interest rate levels created a strong market as investors turned to land as a tangible investment as a hedge against inflation. Proposals to change capital gains taxes also spurred the usage of 1031 exchanges.

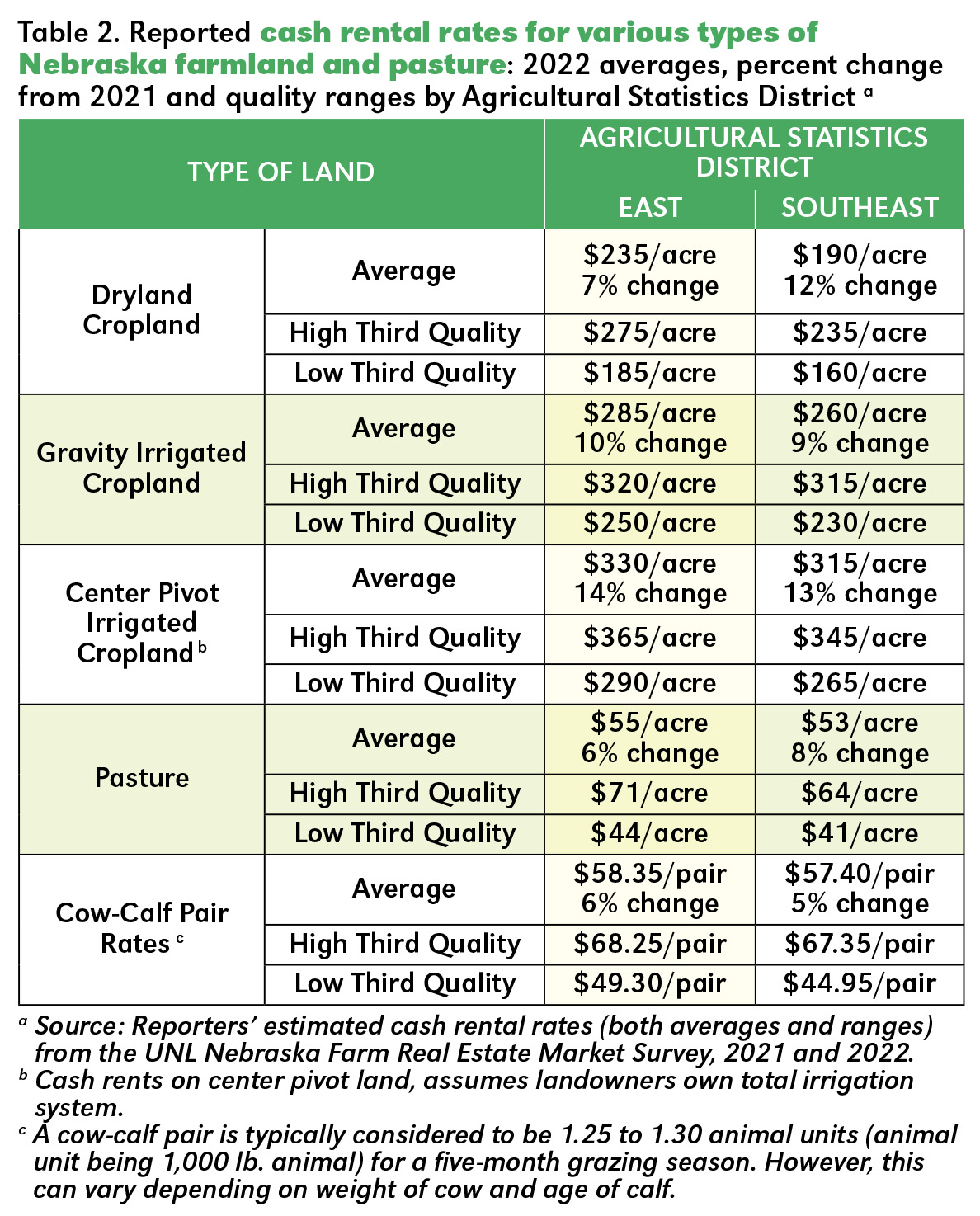

Source: Cornhusker Economics, March 16, 2022.

FOR MORE INFORMATION

Read the Cornhusker Economics full article at https://cap.unl.edu/realestate. For questions regarding this survey, contact Jim Jansen at 402-261-7572 or jjansen4@unl.edu.